- Capital Insider Club

- Posts

- Why Budgets Are the Backbone of Every Winning Grant Application

Why Budgets Are the Backbone of Every Winning Grant Application

To all my entrepreneurs, founders, or nonprofit leaders, this is for you.

So, let’s discuss something that I get the most questions about… the BUDGET!

If there’s one thing that separates grant applications that get funded from the ones that sit in a rejected pile, it’s definitely the budget.

Most entrepreneurs, founders, and nonprofit leaders underestimate the critical importance of a budget.

And not just as an accounting task, but as the most persuasive piece of evidence that you know what you’re doing and you’ve thought it all through.

Today, we’re discussing the differences between types of grants, what a good budget looks like versus a bad one, and what you should actually pay attention to when you build yours.

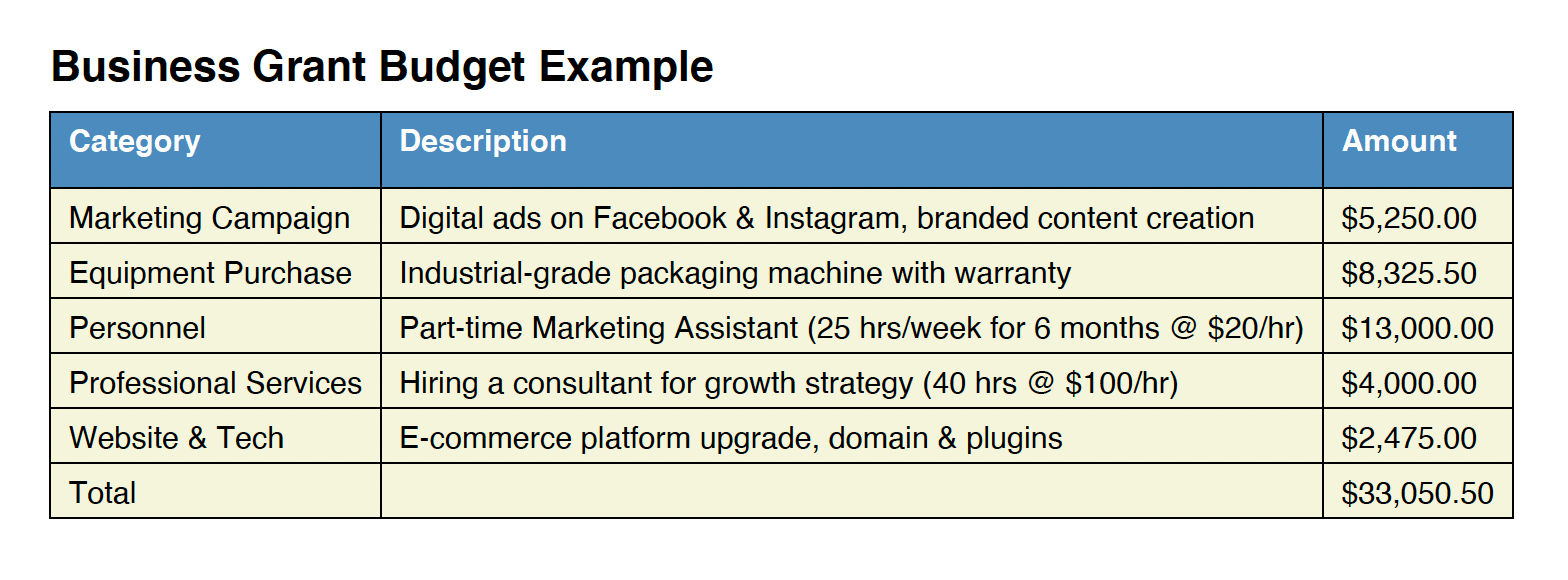

Business Grants vs. Foundation Grants vs. Federal Grants — What’s the Difference?

Even seasoned fundraisers get this confused, so let’s start from the beginning.

Business Grants

Business grants are often offered to small businesses and startups by corporations, economic development agencies, or private funders who specifically support business growth or project-based initiatives. These grants can be for:

• Launching a product

• Expanding into a new market

• Research & development

• Hiring or infrastructure

They tend to be less rigid than federal grants, with more emphasis on your business plan and projected outcomes than on detailed cost breakdowns. Some corporate business grants also include mentoring, marketing support, or visibility and exposure as part of the package.

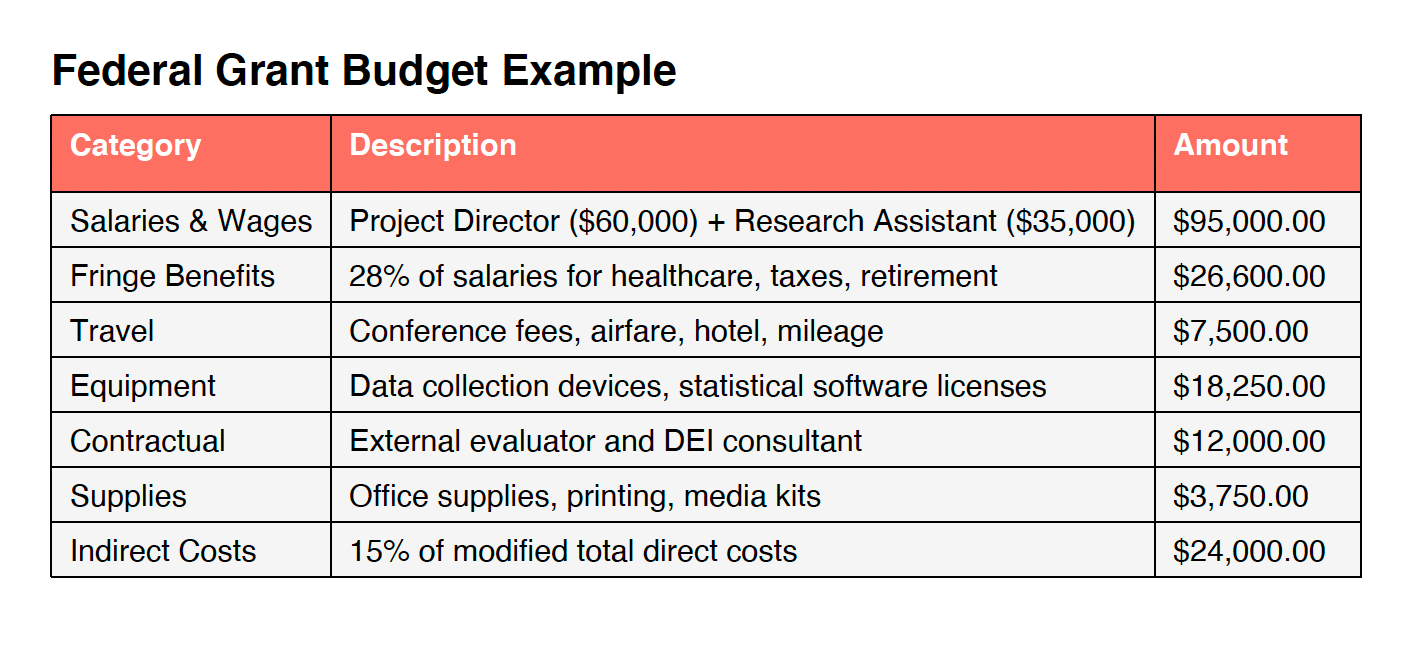

Federal Grants

These are awards funded by the government, from city, state, or especially federal agencies like NIH, HUD, DOE, or NSF.

Federal grants have:

• Highly structured application formats and budget requirements

• Strict rules on eligible costs

• Detailed reporting expectations

Federal grants can fund large-scale projects and research & development initiatives with local agencies, nonprofit organizations, or universities/colleges, and are often the most lucrative. But because they’re designed to ensure taxpayer dollars are used appropriately, the budget and narrative must be absolutely airtight and justified.

Government budgets, for example, require itemized costs and often a budget narrative that ties every line item back to the work you put together.

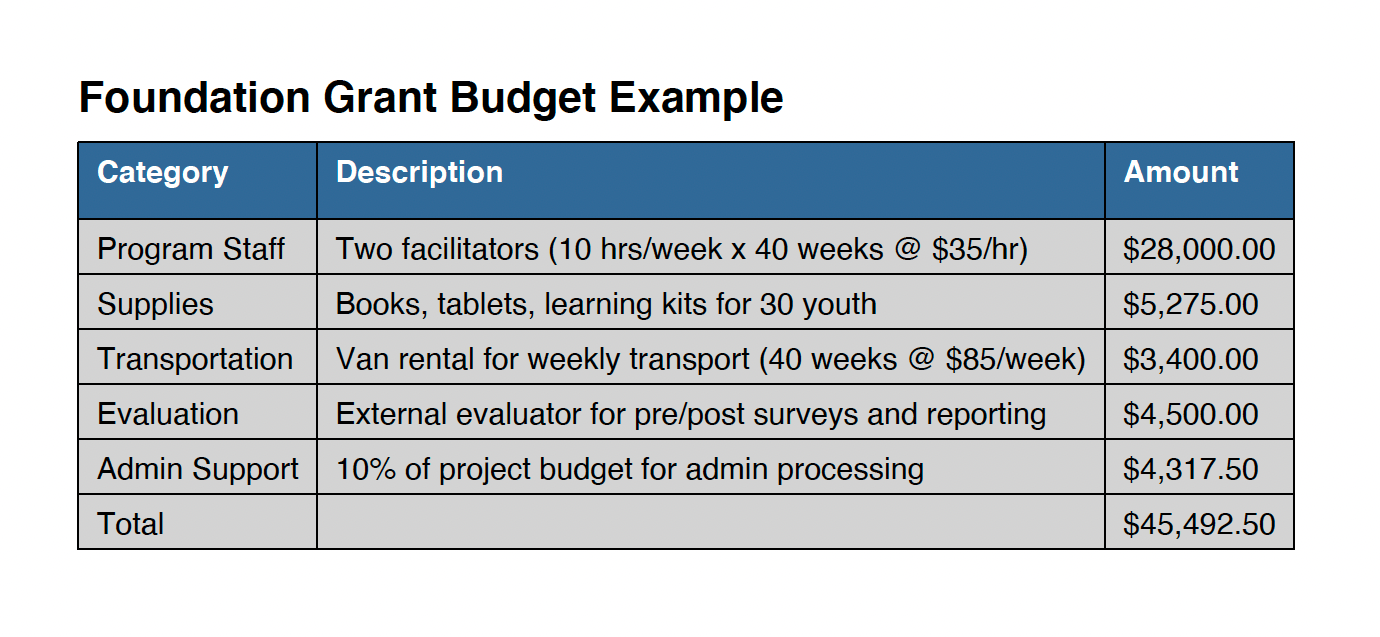

Foundation Grants

Private or family foundations fund missions that align with their values and giving strategy. Unlike federal grants, foundations often give to nonprofit organizations and are more flexible. They expect the story, impact, and alignment with your mission to be at the front and center. They may not demand a super technical budget format, but they do want:

• clarity

• reasonableness

• strong alignment with what they fund

And because foundation grants are typically more mission‑driven and less bureaucratic than federal grants, they can be a great first step to build your track record.

Know the type of grant you qualify for and can apply to.

Federal equals strict rules and detailed financial justification, foundation equals mission alignment with clear rationale, and business grants showcase growth logic with operational foresight.

What Makes a Good Budget and What Doesn’t

Your budget is not math homework. It’s part of your case that your project is real, achievable, and impactful.

What a Good Budget Looks Like

A good budget is:

Comprehensive – Every cost that supports your project’s success is listed.

Transparent – Numbers are justified and linked to real quotes or historical costs.

Aligned – Your budget reflects what your narrative promises. For example, if you want to deliver 100 training workshops, your staff time, materials, venue costs, and travel should all show up in the budget.

Well‑explained in the Budget Narrative – The budget narrative explains why each cost is necessary and how it contributes to the project goals. For federal grants, this narrative is required and strategic, connecting the dots between goals and expenses.

Realistic – Your numbers are neither pulled from thin air. They reflect actual estimates.

A practical way to think about this: a good budget is like a well‑dressed business pitch, where every number and description makes your idea look more credible.

What a Bad Budget Looks Like

A bad budget:

Has vague line items (e.g., miscellaneous $5,000)

Doesn’t match the written proposal

Omits critical costs (like staffing or project management)

Includes ineligible or unexplained expenses

Isn’t justified with reason or data

This kind of budget hurts your credibility and signals to reviewers that you either didn’t plan this thoroughly or don’t understand what you’re proposing, and grant reviewers notice.

Beyond Just Numbers

A budget does far more than tally your expenses. It:

Shows Funder Confidence in Your Planning

Reviewers want to fund feasible work that’s detailed, and compelling budgets show you’ve thought through every step and cost, reducing risk in their eyes.

Connects Your Vision to Execution

A narrative backed by numbers makes your project believable. It translates goals into action.

Helps You Manage the Money

You can’t track impact if you don’t know where funds should go. A solid budget becomes your internal financial roadmap.

Influences Your Funding Success

A poorly constructed budget is one of the top reasons grant applications get knocked out early in reviews. Funders look for clarity, logic, and justification. A messy budget weakens even the best ideas.

What to Watch Out For When Building Budgets

Focus on those guidelines and pay attention to:

Eligible vs. ineligible expenses — Not all costs are allowed. Some grants explicitly refuse certain budget categories.

Indirect costs — Some funders cap or exclude overhead, while others allow a percentage. Know before you ask.

Funder giving range — Don’t ask for more than what they typically fund.

Matching or cost‑share requirements — Some government funds want you to put skin in the game.

Narrative consistency — Your budget should be a financial embodiment of your written proposal.

Tips for All Grant Types

Start with the guidelines. Budgets should follow the format required by the funder (i.e. federal, foundation, or business).

Work backward from outcomes. Think about: What do I need to accomplish this? Research and price it accordingly.

Use real quotes and estimates. Back up your numbers with current market data.

Write your budget narrative after your budget. This helps you explain the costs with intent, and not some guesswork.

A budget should never feel like an afterthought. It’s your financial blueprint and one of the strongest tools you have to win funding.

Treat it as a part of your funding story. Your proposals will be stronger, clearer, and far more competitive.

Become a club member

If you haven’t already, upgrade to become a club member

As a club member, you’ll receive a weekly capital insider newsletter with:

Weekly Grant Alerts – Opportunities for nonprofits, small businesses, startups, accelerators, and pitch competitions.

Capital Strategy Tips – Learn how to craft donation campaigns, prep for pitches and partnerships, and get investor-ready with confidence.

Donation Growth Hacks – Access to email scripts, storytelling templates, and seasonal giving ideas that actually work.

Club Member Discounts – discounts on all digital products, workshops, and accelerators.

Monthly Funding Lab Live Session- Join Laine Bradley and other members for a 1-hour live coaching call each month

That’s it for this week.

Keep showing up for yourself, for your business, and for your organization.

Laine Bradley